pet insurance reviews washington state: a practical guide to reading between the lines

Reviews can help you see beyond glossy promises. In Washington, terrain, weather, and vet access vary, so what "worked" for a Seattle condo cat might not fit a Spokane trail dog. The goal is simple: use other people's experiences to test how a policy behaves when life isn't tidy.

What people in Washington often look for in reviews

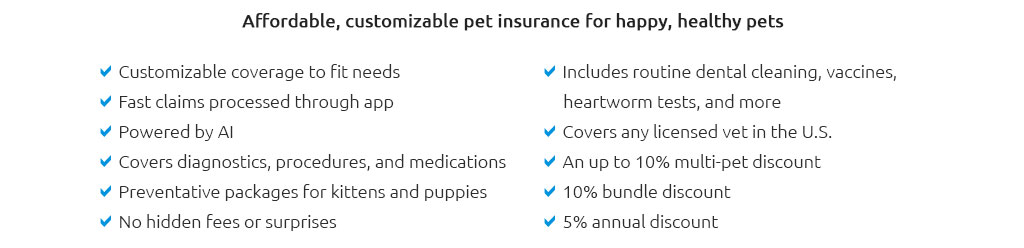

- Claim speed and consistency. Not just "fast," but how quickly payments land during peak times like weekend emergencies.

- Coverage clarity. Are cruciate injuries, dental illness, and chronic conditions handled as expected?

- Premium stability. Notes about increases at renewal, especially when pets reach senior years.

- Ease at the vet. Some insurers support vet-direct pay at participating clinics; reviews will say if it actually worked.

- Customer support tone. Polite is nice. Proactive and specific is better.

Reading star ratings without getting fooled

Five stars can hide small frustrations; one star can be a single bad day. Skim mid-range reviews for detail. Look for patterns across time: repeated themes about waiting periods, sublimits, or document requests carry more weight than any one story.

- Sort reviews by most recent first.

- Capture three positives and three negatives that repeat.

- Match each theme to the policy wording (deductible, exclusions, caps).

- Decide what matters to your pet's risks and your cashflow.

Washington-specific notes

Emergency clinics can be busy across Puget Sound; reviews often mention weekend claims and reimbursement delays after late-night visits. Eastern Washington families sometimes highlight wildlife or wildfire-related injuries. The state's insurance regulator publishes market information and complaint trends; reviewers sometimes reference this when describing claim disputes. Pre-existing conditions and waiting periods show up a lot - people are surprised by how strictly they're defined.

Quick glossary you'll see in reviews

- Deductible: Annual or per-incident; higher deductibles usually lower monthly cost.

- Coinsurance: Your share after deductible (e.g., 20% when reimbursement is 80%).

- Reimbursement %: 70 - 90% is common; applies to eligible costs only.

- Waiting periods: Time after enrollment before certain claims are eligible.

- Bilateral conditions: If one knee is injured, the other knee may be excluded later.

- Exam fees: Some plans include them; others don't - reviews often flag surprises here.

- Therapies: RX diets, rehab, acupuncture - coverage varies widely.

Two brief review snapshots, and what they signal

"Claim paid in four days after ER visit in Tacoma, but deductible reset caught me off guard." Signals speed is decent; deductible type likely annual vs per-condition confusion.

"Policy great for meds; premium jumped at age 8 in Bellingham." Signals strong pharmacy coverage; expect age-based increases and plan accordingly.

A real-world moment

At a rainy Tuesday check-in in Ballard, a dog parent quietly scrolled three Washington reviews about knee injury claims, then asked the receptionist if the clinic supported direct pay; that five-minute check changed which plan they kept before authorizing surgery, and it felt like a calm, informed choice.

How to compare policies in under an hour

- Set a monthly budget and a maximum out-of-pocket for a bad month.

- List must-haves: cruciate coverage, dental illness, chronic meds, exam fees.

- Get sample quotes for your pet's age and breed with two deductibles.

- Run a test scenario: $2,500 ER bill, see what each plan pays and when.

- Read five most recent negative reviews per insurer; note recurring causes.

- Call your vet: ask if they've seen smooth claims or vet-direct pay success.

- Pick the plan that best fits your risk pattern, not the highest rating alone.

Red flags in reviews

- Denials tied to notes from a "first exam" before enrollment.

- Long waiting periods for knees/hips not clearly disclosed.

- Many mentions of sublimits (per-incident caps, per-condition caps).

- Premium spikes after small claims, or unpredictable renewal jumps.

- Repeated requests for the same records causing multi-week delays.

Green lights in reviews

- Consistent reimbursement timelines with dates and dollar amounts.

- Clear pre-approval communication for big procedures.

- Plain-language policy docs that match phone explanations.

- Stable renewals with reasons explained, not just "market conditions."

- Helpful support during off-hours and fast e-pay once approved.

Value shifts by pet and place

Active dogs in the Cascades see different risks than indoor cats in Bellevue. Larger breeds may face orthopedic issues; cats often rack up savings on dental illness and chronic meds. Reviews from your city can hint at local clinic workflows and turnaround times.

A short worksheet for pulling value from reviews

- Write three risks your pet is most likely to face.

- From reviews, tally how often each plan pays those risks smoothly.

- Note average days-to-pay and any paperwork pain.

- Circle one deal-breaker (e.g., knee exclusions) and one must-have benefit.

- Re-check annually as premiums and your pet's health change.

The best review isn't the loudest; it's the one that mirrors your pet and your tolerance for surprise, and you can keep refining that picture as your life in Washington shifts a bit year to year.